No Re-registration Fee or Token Tax Required for Vehicles Transferred to Another State or UT

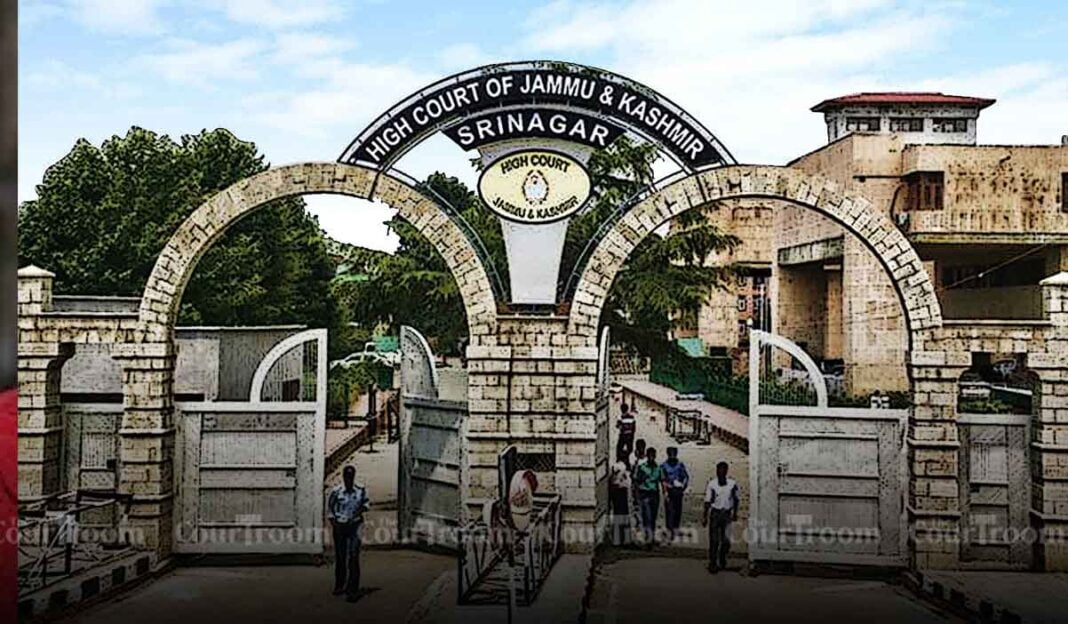

The Jammu and Kashmir High Court, in a recent ruling, addressed the legal implications of transferring a vehicle from one State or Union Territory (UT) to another within India. The case involved a petition challenging the demand of a token tax by the Regional Transport Officer (RTO) in Kashmir for assigning a new registration mark to a vehicle registered in Haryana [Ishfaq Ahmad Tramboo v. UT of J&K and Others].

Justice Javed Iqbal Wani, presiding over the case, clarified that under the Motor Vehicles Act, 1988, a motor vehicle needs to be registered only once upon payment of the prescribed fee, which is valid throughout India. The Court underscored that there is no legal provision for the re-registration of a vehicle or additional fee demands if it is taken to another State or UT.

However, the Court highlighted that if a vehicle is transferred to another State or UT and remains there for over 12 months, a new registration mark specific to that region must be assigned. In such instances, the registering authority of the new region is required to coordinate the transfer of records from the original registration authority.

Importantly, the Court emphasized that a vehicle owner should not be subjected to token tax or road use tax again, simply for using the vehicle in another State or UT. In this particular case, petitioner Ishfaq Ahmad Tramboo had purchased a vehicle in Haryana and brought it to Jammu and Kashmir in 2023. When the RTO in Kashmir demanded a 9% tax on the vehicle’s value, which amounted to ₹4 lakhs, as a condition for re-registration, Tramboo challenged the demand in court.

Justice Wani, relying on a previous Division Bench judgement in Zahoor Ahmad Bhat v. Government of J&K, ruled that such a tax cannot be levied based on the mere presumption that a vehicle had remained in the UT for over 12 months. The Court ordered the RTO to assign a new registration mark for the vehicle without imposing the token tax.

The ruling granted the petitioner relief and directed the RTO to assign the UT’s registration mark within four weeks. The Court also allowed the respondents to approach the Haryana registration authority for a refund of any token tax already paid.

(With inputs from agency)

Share your news, articles, deals, columns, or press releases with us! Click the link to submit and join our platform today.